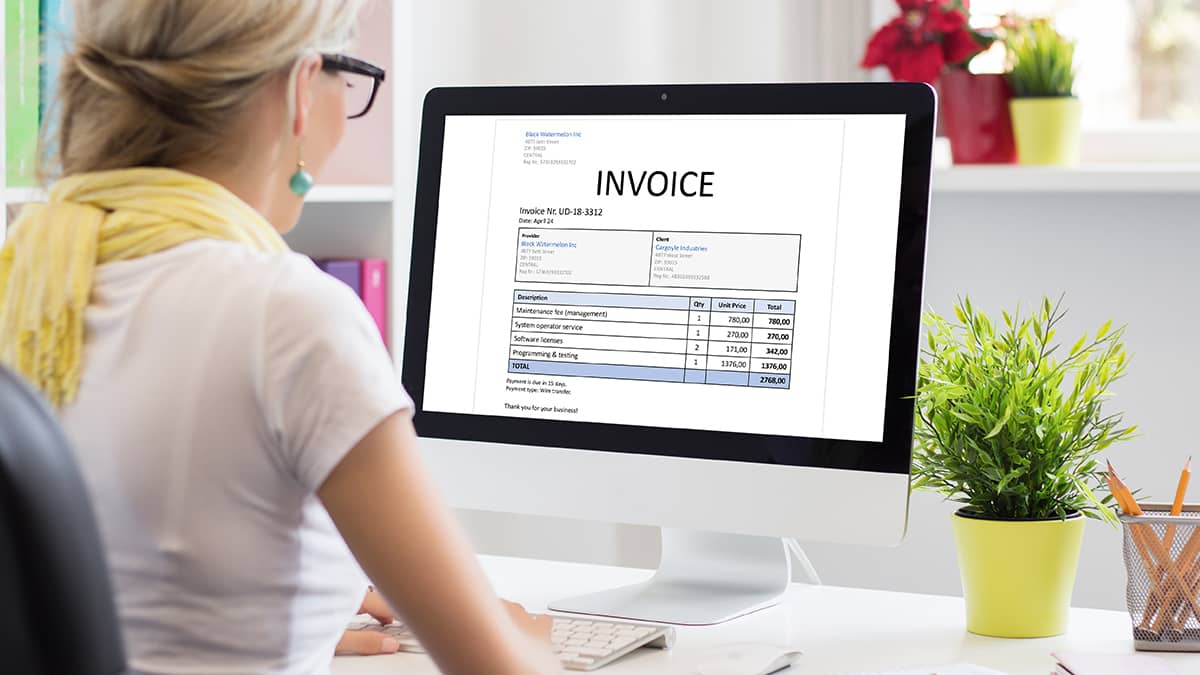

A business must handle numerous transactions, and the need for e-way bills becomes necessary with the delivery of goods and transportation. E-invoicing might add another burden to your already arduous daily schedule of business duties. A safe and complete e invoicing software is therefore required to streamline the process of not only creating IRNs but also printing and sharing invoices, managing e-way bills, and filing an effective ITC claim.

Here are 7 ways an e-invoicing program can make your e-invoicing simpler:

Your current billing procedures can easily be integrated with an e-invoicing program. Companies have different billing procedures that they use. Moreover, invoices could be produced immediately after a transaction is completed or later in batch mode. Your e-invoicing solution ought to function well for you with minimal interference. This will guarantee a smooth beginning and continued ease of use for your e-invoicing journey.

Your current ERP or billing systems can be integrated with an e-invoicing program.

Nowadays, a lot of firms use ERP (Enterprise Resource Planning) software packages. A business may operate with one or more systems as well. In addition to being coupled with your ERP or current billing system, your e-invoicing software will make your job easier by automatically pulling data. Working separately on two systems (ERP and e-invoicing software) is not a concern.

It is capable of handling all e-invoicing processes (e-invoice cancellation and e-way bill)

Every document covered by the scope of the e-invoicing mandate must generate an IRN. Nonetheless, there may be commercial circumstances when the document needs to be revoked. There is a 24-hour cancellation window offered by the E-invoice Portal. Moreover, in addition to IRN, an e-way bill can be generated if it applies to you. IRN can be used to process E-way bills with validity.

It can be used for more than only e-invoicing operations (print and share e-invoice)

The next step is to send the customer the invoice when an IRN has been generated, either with or without an E-way Bill. The digitally signed QR code must be included on the invoice copy at the very least. You should be able to print an invoice with a QR code and transmit it to the appropriate parties using your e-invoicing software. This will make the process more efficient.

Any time, obtain historical e-invoice data

Data is only kept on the E-invoice site for two days after IRN generation. Consequently, after two days, you wouldn’t be able to access the uploaded invoices if you wanted to check the information. An e-invoicing software solution, however, goes past this restriction and gives you instant access to all the historical data.

Final Thoughts

It is a cloud-based solution that can create IRN with no interference to your business and smoothly interface with your invoicing systems in several ways. It provides a one-stop shop for creating, viewing, and sharing electronic invoices, collaborating with clients, and managing all interactions with GST systems without fuss.